As user demand continues to grow for new ways to spend, swap and store their crypto, a multitude of exchanges and wallet providers have entered the market. This has given crypto users a bevy of options when it comes to managing their holdings.

But with so many types of crypto wallets out there, it can be difficult to decide on which combination of attributes makes the most sense for your personal crypto usage style. Ahead we will break down the different types of wallets available today, which should help you make a more informed decision.

A crypto wallet securely stores your private keys, which are required to access your funds on the blockchain. There are two main types, “hot” wallets, which remain connected to the internet, and “cold” wallets, which function primarily offline.

Custodial crypto wallets require you to safeguard your own private keys, while self-custody wallets (aka non-custodial) entrust that security to a third-party, usually a crypto exchange.

Wallets come in multiple forms, including web, desktop, hardware and even paper. Which one is right for you will depend on your crypto goals and usage habits. However, it is advantageous to use multiple wallets for different purposes (example: hardware wallet for saving, mobile wallet for regular spending).

In this article

What is a crypto wallet? How do crypto wallets work?

The purpose of a crypto wallet is to allow users to interact with the blockchain, either using software or a specialized hardware device. The name wallet is perhaps a bit of a misnomer, considering they aren’t actually used to hold cryptocurrency. Instead, wallets serve as an intermediary between a user and their holdings, which “live” on the blockchain.

With a wallet, a user is able to view and manage their cryptocurrency, as well as initiate transactions. They exist in numerous forms, from easy-to-use online web wallets offered by leading crypto exchanges to more technically complex and secure offline, hardware-based wallets.

What all wallets have in common is keys, which are needed to access a user’s crypto assets. When a wallet is created, a pair of keys are generated, one public and one private. These lengthy alphanumeric sequences may appear similar, but their functions are drastically different.

A public key is like a bank account number; it can be shared at will with anybody who wants to send you cryptocurrency, much like how an account number appears at the bottom of a paper check. A private key, on the other hand, can be thought of as your bank account’s PIN code, and should be carefully safeguarded. Anyone who has access to that private key will have complete control over your crypto holdings.

When a user wants to send cryptocurrency, whether it’s to pay for an upcoming trip or buying a new watch, they input the destination wallet’s public key and the amount of crypto they wish to send. The process is reversed when a user instead wishes to receive crypto. Anytime cryptocurrency moves out of a wallet, the transaction must be “signed” using the private key. How that crucial step happens depends on the type of wallet you use.

The best self-custody wallet for buying, storing, swapping and spending crypto

Get the BitPay Wallet App

Cold Wallets vs Hot Wallets

Backing up a moment, before delving into the different types of crypto wallets and how they work, it’s important to understand that wallets are divided into two distinct categories: “Hot” and “cold” wallets.

A hot wallet simply means any crypto wallet that is connected to the internet. They’re generally easy to use, so most types of crypto wallets are of the “hot” variety. Hot wallets’ always-on nature makes them excellent for convenience, but that very same trait also makes them more vulnerable to hackers. Because of this, it is not recommended to keep large amounts of cryptocurrency in a hot wallet.

Cold wallets, as you may have guessed, encompass any type of wallet that is offline, or not connected to the internet. Since the only way to interact with the blockchain is through the internet, cold wallets are considered highly secure and virtually impervious to hacking. Cold wallets tend to require a bit more technical know-how, so they’re typically suited for more experienced users or those with large amounts of assets.

Types of hot wallets

For users who always want their crypto by their side and ready to spend, hot wallets are usually the go-to choice. There are several different types of hot wallets available, each with potential benefits and drawbacks depending on your needs.

Desktop wallets

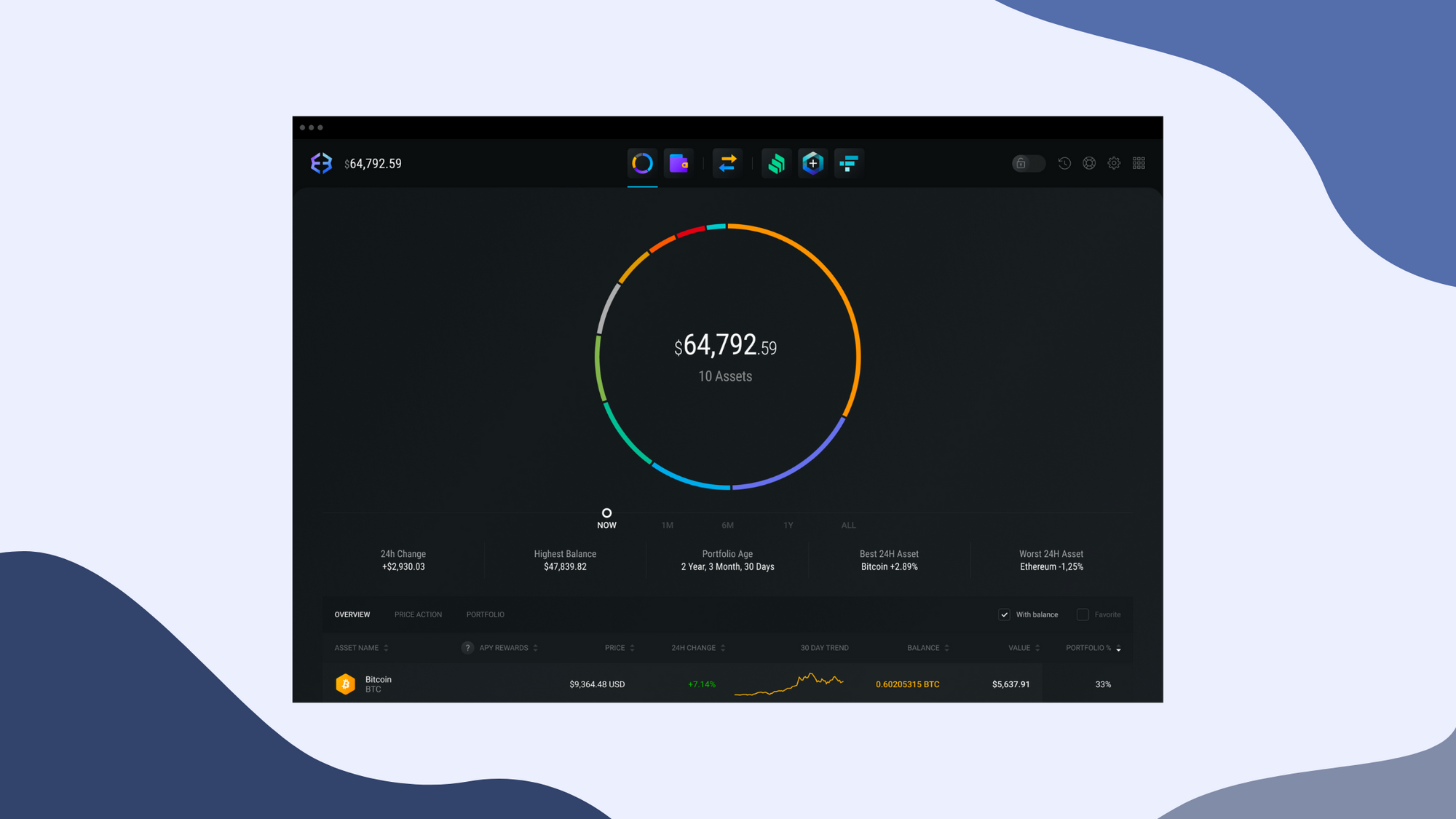

Desktop wallets utilize encryption to keep a user’s private keys securely stored on their computer hard drive. Read our deep dive into desktop wallet.

Pros

- Excellent for securely conducting small crypto transactions using a computer

- Free and easy to use

- No third-party holds your private keys

- Some can be used offline for cold storage

Cons

- Most are online anytime your computer is

- Potentially vulnerable to malware or computer viruses

- Anyone who has access to your computer could potentially access your crypto

Recommended desktop wallets: BitPay, Exodus, Electrum

Web wallets

Web wallets are wallets provided by a third party, typically a crypto exchange, which offer seamless access to a user’s holdings using a web browser.

Pros

- Easy to use; generally favored by most crypto newcomers

- Support a variety of transactions (buy, sell, swap etc.)

- Account security outsourced to trusted third-party (exchange, etc.)

Cons

- Requires trusting a third party to secure your private keys

- Potentially vulnerable to hackers

- Computer used to access web wallet also subject to threats like viruses, malware and keyloggers

Recommended web wallets: Coinbase, Metamask, Guarda

Mobile wallets

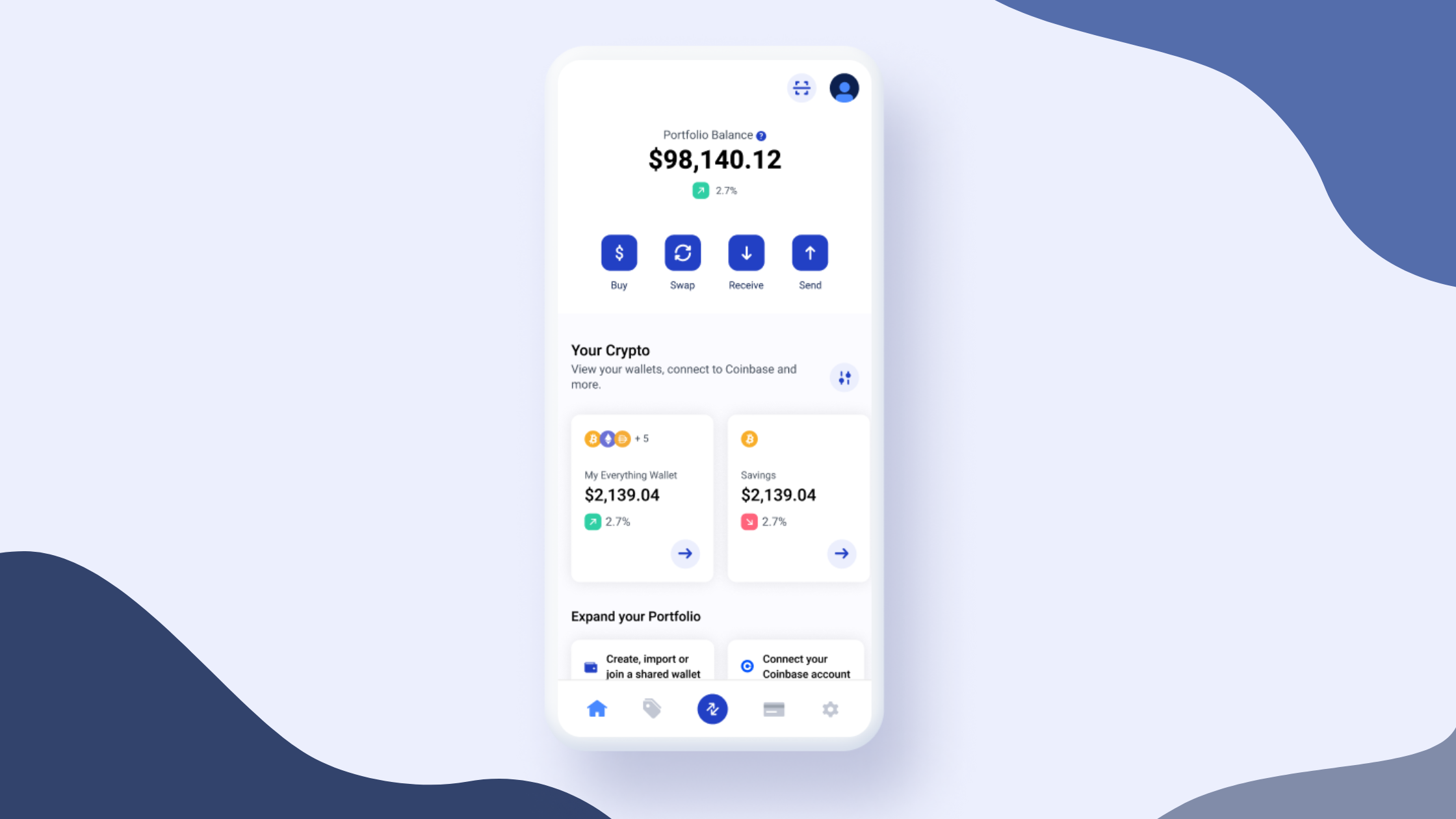

Mobile wallets allow users to quickly and securely spend or receive cryptocurrency anywhere they have their phone and an active internet connection. Read our expanded guide to mobile crypto wallets.

Pros

- Easily send or receive crypto payments on the go

- Highly convenient and easy to use

- One of the easiest ways to spend cryptocurrency

Cons

- Holdings are only as secure as your phone

- Account could be compromised if device is lost or stolen

- Like a computer, phones are potentially vulnerable to viruses and malware

Recommended mobile wallets: BitPay, Edge, Trust, Electrum, Blockchain.com

Custodial vs. non-custodial wallets

Before getting into types of cold wallets, another key distinction to talk about is custodial vs. non-custodial crypto wallets. The primary difference between these options comes down to security over convenience, and who is responsible for securing a wallet’s private keys.

With a custodial wallet, a third-party like a crypto exchange holds a user’s private keys, using them to “sign” initiated transactions on the owner’s behalf. Custodial wallets are good for users who don’t want to fuss too much with security, and who aren’t overly concerned with trusting a third party to their private keys. Because of risks like hacks, or even an exchange going bankrupt (which has happened before), it’s generally not advised to keep large amounts of cryptocurrency in a custodial wallet.

For more advanced crypto users, or those who want to be in complete control over their private keys, non-custodial wallets are often preferred. These wallets are also known as “self-custody” wallets. With a self-custody wallet, the holder is solely responsible for keeping their private key safe. Non-custodial wallets don’t require a user to trust a third-party for account security, but it does require a substantial amount of self-trust. Remember, if a private key is lost or compromised, a user’s funds can be drained or otherwise rendered irretrievable.

Related article: All About Bitcoin Wallets

Types of cold wallets

Those who would rather take charge of their own account security generally opt for a cold wallet. The two most popular types of cold wallets, hardware and paper, fall on opposite sides of the technology gamut. Paper wallets are about as low-tech a solution as you can get, while hardware wallets often contain sophisticated high-tech components. Both are considered a highly secure way of securing your crypto.

Paper wallets

As the name suggests, a paper wallet is an offline wallet solution where private keys are written down or printed and securely stored.

Pros

- Being completely offline makes it impossible to hack

- No third-party has control of your private keys

- Optional inclusion of QR code allows for easier access

Cons

- Paper can be easily lost, stolen, incinerated or otherwise destroyed

- Requires more time and effort to move crypto between wallets

- More technical know-how needed

Recommended paper wallets: Some may prefer a good old-fashioned paper and pen approach, but it’s also dead simple to create your own secure, printable paper wallet. In fact, there are entire websites dedicated to it, such as WalletGenerator.Net and BitcoinPaperWallet.com.

Hardware wallets

For those who prefer a more high-tech solution, a hardware wallet offers secure private key storage in a number of formats. These physical devices, often resembling a USB thumbdrive, are offline unless plugged into a computer or mobile device. Learn how to use a hardware wallet like a whale.

Pros

- One of the most secure methods of crypto storage

- Transactions are signed using private key offline, and only online to upload the transaction to the blockchain

- Available at most major electronics retailers

Cons

- Not free; Priced between $30-$200

- Can be challenging for crypto beginners

Recommended hardware wallets: Ledger Nano S, Trezor Model One, Ledger Nano X

Which crypto wallet should I choose?

Before deciding between crypto wallet options, take stock of your priorities, asking yourself how much you value things like ease-of-use and security. Think about how easily accessible you want your crypto to be, and how much security you’re willing to trade for that convenience. That is the formula most people evaluate when choosing what wallet is right for them.

The BitPay is a self-custody wallet available for your mobile device or desktop. With an intuitive UI and advanced features, it is a safe and secure option for newcomers or advanced crypto users alike.

BitPay gives crypto enthusiasts a safe, simple and quick way to buy Bitcoin and other cryptocurrencies. Buy with no hidden fees at competitive rates. Additionally, BitPay offers you convenient ways to pay for your crypto buys – credit card, debit card, bank transfers, Google Pay, Apple Pay, and other local banking methods.

After buying Bitcoin, manage your assets with the all-in-one BitPay Wallet app featuring industry-leading security.

It also contains the best features to help you pay with crypto like a directory of merchants that accept crypto, an easy option to buy gift cards with crypto straight from the wallet and a free crypto debit card.

The best self-custody wallet for buying, storing, swapping and spending crypto

Get the App

![Types of Crypto Wallets Explained: Which One is Right for You? [2023]](https://approx.org/wp-content/uploads/2024/01/types-of-crypto-wallets-bitpay-750x375.jpg)