China reportedly cut its U.S. Treasury holdings for a ninth straight month, pushing exposure to the lowest level since 2008. Bitcoin held firm near recent highs as gold surged toward $4,200, showing how markets react when faith in U.S. debt slips. This move fits a wider trend: central banks are slowly stepping away from the dollar.

For everyday investors, this is not abstract geopolitics. When big countries sell U.S. debt, it changes how money flows across stocks, bonds, gold, and Bitcoin. That ripple can reach your portfolio faster than you think.

This Analysis matters because Bitcoin often feeds off macro uncertainty. When trust in traditional systems wobbles, people search for alternatives.

DISCOVER: Top Ethereum Meme Coins to Buy in 2026

What Is Really Happening With China and U.S. Debt?

U.S. Treasuries are government IOUs. Countries buy them because they are liquid and historically stable. China once held over $1.3 trillion, but that number has slid for 15 years.

Now, China has sold Treasuries for nine months in a row. This puts China at its lowest exposure since the global financial crisis. So what? When a major buyer steps back, it signals less confidence in U.S. debt as the world’s default safe asset. That opens the door for alternatives.

Why Bitcoin Keeps Showing Up in This Conversation

BREAKING: The US Dollar now represents ~40% of global currency reserves, the lowest in at least 20 years.

This percentage has declined -18 percentage points over the last 10 years.

Over the same period, gold’s percentage has increased +12 points, to 28%, the highest since the… pic.twitter.com/M0BqI09iQ4

— The Kobeissi Letter (@KobeissiLetter) January 9, 2026

Global dollar reserves now sit near 57–58%, the lowest since the 1990s. At the same time, central bank gold holdings have doubled since 2014. Bitcoin enters the chat as a digital alternative to gold. Think of it as a global savings account that no country controls. That story gets louder when trust in government debt fades.

This does not mean that Bitcoin will replace the dollar tomorrow. It means Bitcoin benefits from the same fear that pushes gold higher.

DISCOVER: Top 20 Crypto to Buy in 2026

Who Wins and Who Feels the Pressure?

(Source: GOLD Price / TradingView)

Gold has already responded, rising to $4,200 per ounce in late 2025 as central banks diversified. Bitcoin tends to lag, then catch up, as retail investors process the same story.

On the other side, the U.S. faces higher pressure to attract buyers for its debt. Even Japan hinted its $1.1 trillion Treasury stack could become a trade negotiation tool.

For beginners, this explains why Bitcoin sometimes rises when traditional markets feel uneasy. It trades on trust, not cash flow.

The Risk Check Most Headlines Skip

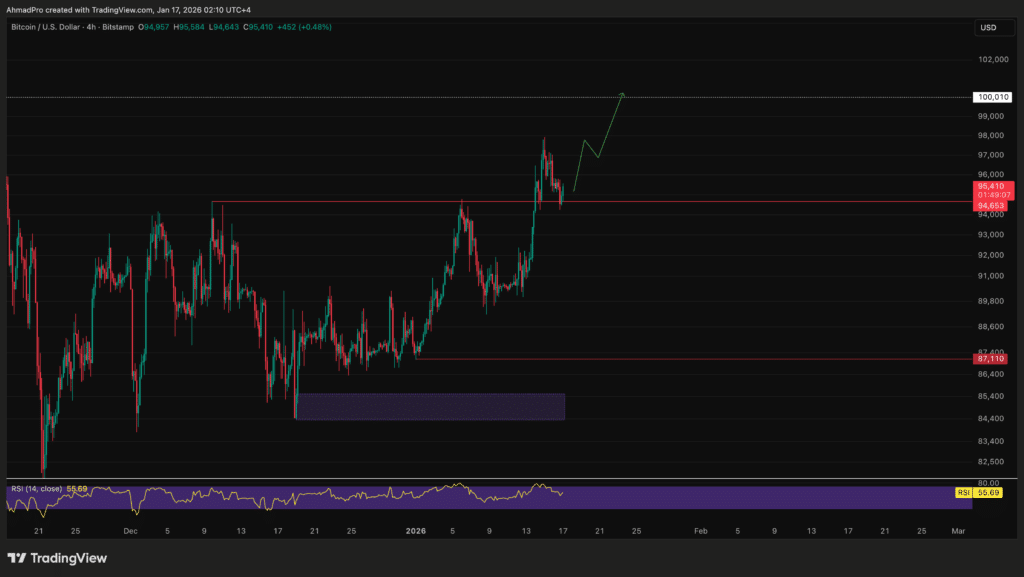

(Source: BTCUSD / TradingView)

Bitcoin is volatile. A macro narrative can boost interest, but price still swings hard. Short-term drops can happen even during long-term adoption stories.

Also, central banks are not buying Bitcoin directly. They still favor gold and local currency systems. Bitcoin gains attention mainly from investors, not governments.

Translation: this is a tailwind, not a guarantee. Never treat macro stories as a green light to bet rent money.

As de-dollarization continues, Bitcoin stays in the spotlight as a hedge narrative. Watch how gold and Treasury demand move next, because Bitcoin usually listens.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post China Dumps U.S. Treasuries: Here’s Why Bitcoin Cares appeared first on 99Bitcoins.