Justin Bons, the founder and CIO of CyberCapital, has laid out a blunt and unsettling view of where Bitcoin could be headed over the next decade. In a detailed note shared on X, Bons noted that Bitcoin is moving toward total collapse within the next seven to 11 years, which is going to be caused by the way the network pays for its security and the continued fall of block rewards.

Reduced Miner Payouts To Cause Complete Bitcoin Collapse?

Bitcoin is known for its halving cycle, which reduces the block rewards given to miners by about 50% every 210,000 blocks, which comes up to about roughly four years. Bons’ critique focuses on this event as the reason why Bitcoin’s network security will finally fail and cause a complete collapse of the leading cryptocurrency.

As each halving cuts the block rewards further, Bons believes Bitcoin is drifting toward a point where it can no longer reliably fund the miners who protect the network, setting off a chain of risks that become harder to ignore with every cycle.

Many Bitcoin proponents will argue that the Bitcoin network is still highly secure due to the rising hashrate. However, according to Justin Bons, hashrate can rise even while real security is weakening because advances in mining hardware reduce the cost of producing hashes. The most important thing is how much money is actually being made by miners, since that figure represents the profitability and the cost an attacker would have to match or exceed.

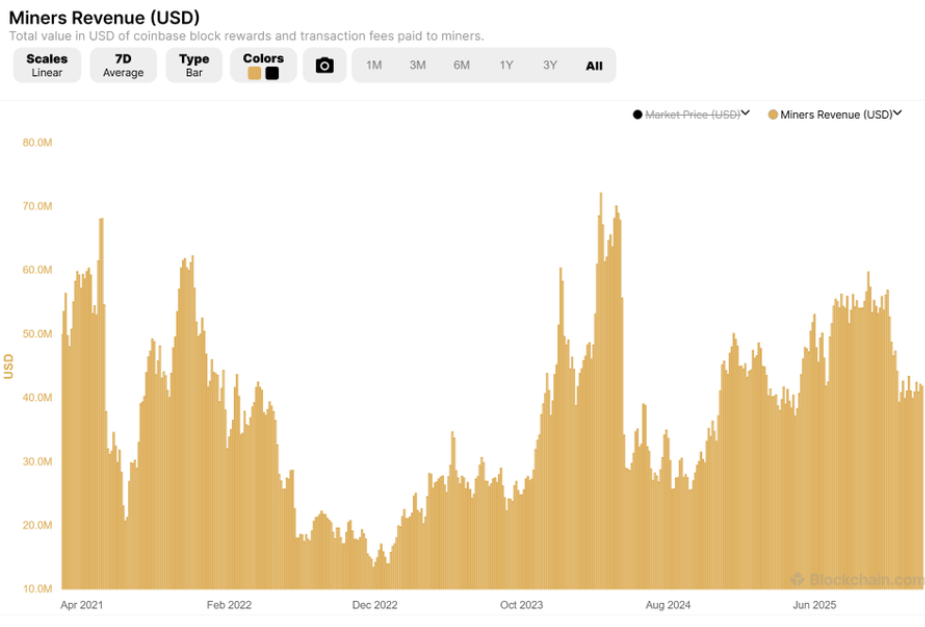

Charts tracking block rewards and miner revenue show that, in economic terms, Bitcoin’s security is already lower than it was several years ago. Keeping security at current levels, he says, would require either transaction fees so high that users would simply stop using the network or the price of Bitcoin to double every four years at a pace that would quickly outpace the size of the global economy.

Bitcoin Miner Revenue. Source: @Justin_Bons on X

Prediction: Bitcoin To Plunge In Two To Three Halvings

The seven to 11-year timeframe Bons outlined for Bitcoin’s collapse is tied directly to its halving schedule. According to the industry expert, the cost of attacking the Bitcoin network for a sustained period could fall into territory that makes such attacks financially attractive within two to three more halvings.

If miner payouts are low enough, Bons believes the potential rewards from hitting multiple exchanges or protocols could outweigh the cost of carrying out the attack. The most realistic scenario for this to happen is through double-spend attacks against exchanges.

An attacker controlling 51% of the entire mining power could deposit Bitcoin, trade it for another asset, withdraw those funds, and then roll back the blockchain to reclaim the original coins.

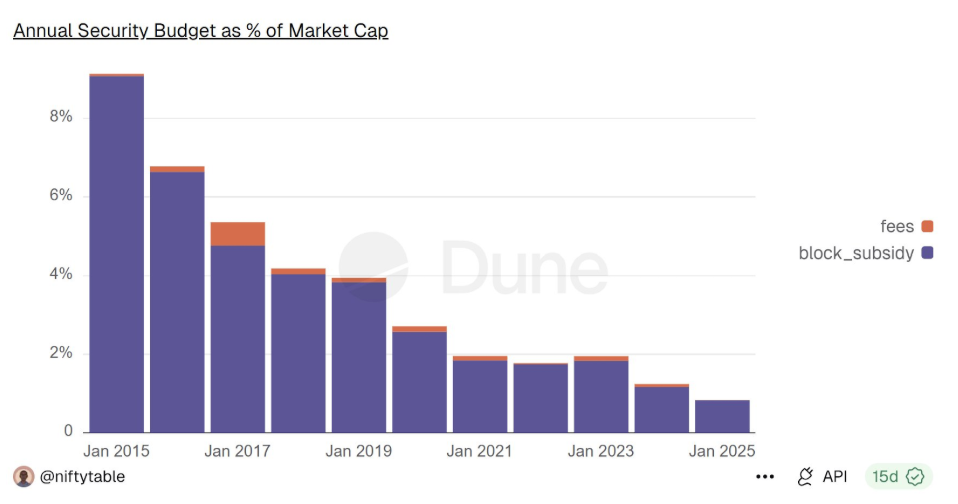

He also highlights data showing that Bitcoin’s security budget relative to its total market value has been trending downward for years. This means Bitcoin does not automatically become safer as it grows larger.

Bitcoin Security Budget as % of Market Cap. Source: @Justin_Bons

This leaves Bitcoin facing an eventual breaking point. From here, it is either the network increases its fixed 21 million supply cap to restore miner incentives, a move that would likely split the chain, or the entire Bitcoin ecosystem accepts the risk of double-spend attacks.

Featured image from Unsplash, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.