Bitcoin has shown early signs of calm, but the mood is fragile. Prices pulled back from a weekend peak and trading has been choppy as investors weigh fresh tariff headlines and slowing growth in parts of Asia.

Related Reading

Spot Market Signals Ease

According to Glassnode, spot trading volume has picked up modestly while the net buy–sell imbalance moved above its usual upper band. That shift points to less sell-side pressure, even if demand is still patchy.

Reports note that markets are slowly rebuilding after late-2025 profit-taking, with long-term holders less willing to sell every rally. The result is a market that is consolidating rather than breaking down.

Derivatives Stress And A Sharp Retest

Over the weekend Bitcoin slid by 3.2% from its high, prompting a retest of the $92,000 level that surprised some bulls. That move wiped out about $215 million in leveraged futures longs, a large hit that raised alarms about deeper losses.

Source: Glassnode

At the same time, weak activity in derivatives markets has flagged a cooling of speculative appetite, which makes it harder for Bitcoin to act as a reliable hedge right now.

Nasdaq futures fell after US President Donald Trump announced new tariff proposals aimed at several European countries, and such macro shocks often push traders out of riskier holds.

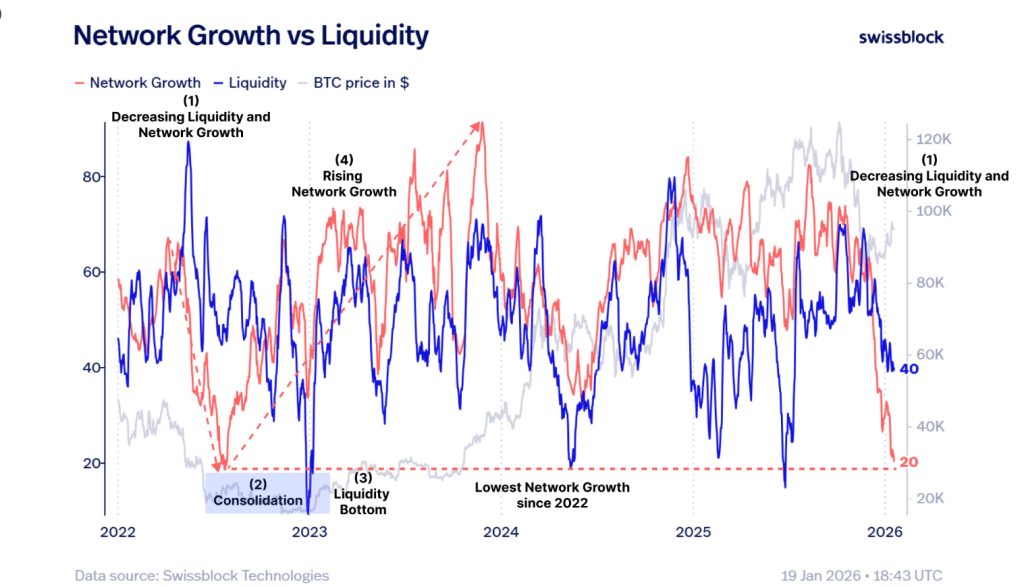

Liquidity Patterns Echo Past Cycles

Analysts at Swissblock pointed to a fall in network growth and liquidity that looks similar to conditions seen in 2022. Back then, low liquidity and a pause in growth led to a long consolidation, only for both indicators to surge later and fuel a big price run.

Based on reports, the current setup could be the prelude to a similar rebuild if network activity recovers and buy-side momentum strengthens.

Network growth has hit lows not seen since 2022, while liquidity continues to drain. Back in 2022, similar network levels triggered a $BTC consolidation phase as network growth began to recover, even while liquidity remained weak and bottoming out.

History shows that the… pic.twitter.com/24sC3aoyAD

— Swissblock (@swissblock__) January 19, 2026

Institutional Flows And Hedge Narratives

Analysts said that ETF flows show institutions buying on pullbacks and that long-term holders are not rushing to sell.

Gold has climbed past $4,650, and that safe-haven move, together with softer growth data in China, is nudging some investors to treat Bitcoin as a portfolio hedge rather than a quick trade.

A Cautious Outlook

Overall, signs point to a slow rebuild rather than a fresh breakout. Buy-side dynamics have improved, but they are not yet strong or broad enough to call a new uptrend. Volatility remains a feature, and geopolitical or policy shocks could push price swings wider.

Related Reading

For the time being, the market is steadying while staying watchful — more recovery in liquidity and clearer institutional conviction would be needed to turn this consolidation into a lasting advance.

Featured image from Gemini, chart from TradingView