Bitcoin is staging a modest rebound after several days of intense selling pressure and fear across the market. The leading cryptocurrency has struggled to establish stable support, with volatile swings making it difficult for traders to navigate. Despite the uncertainty, some market participants continue to move strategically — and one of the most well-known whales has just made a big return.

Related Reading

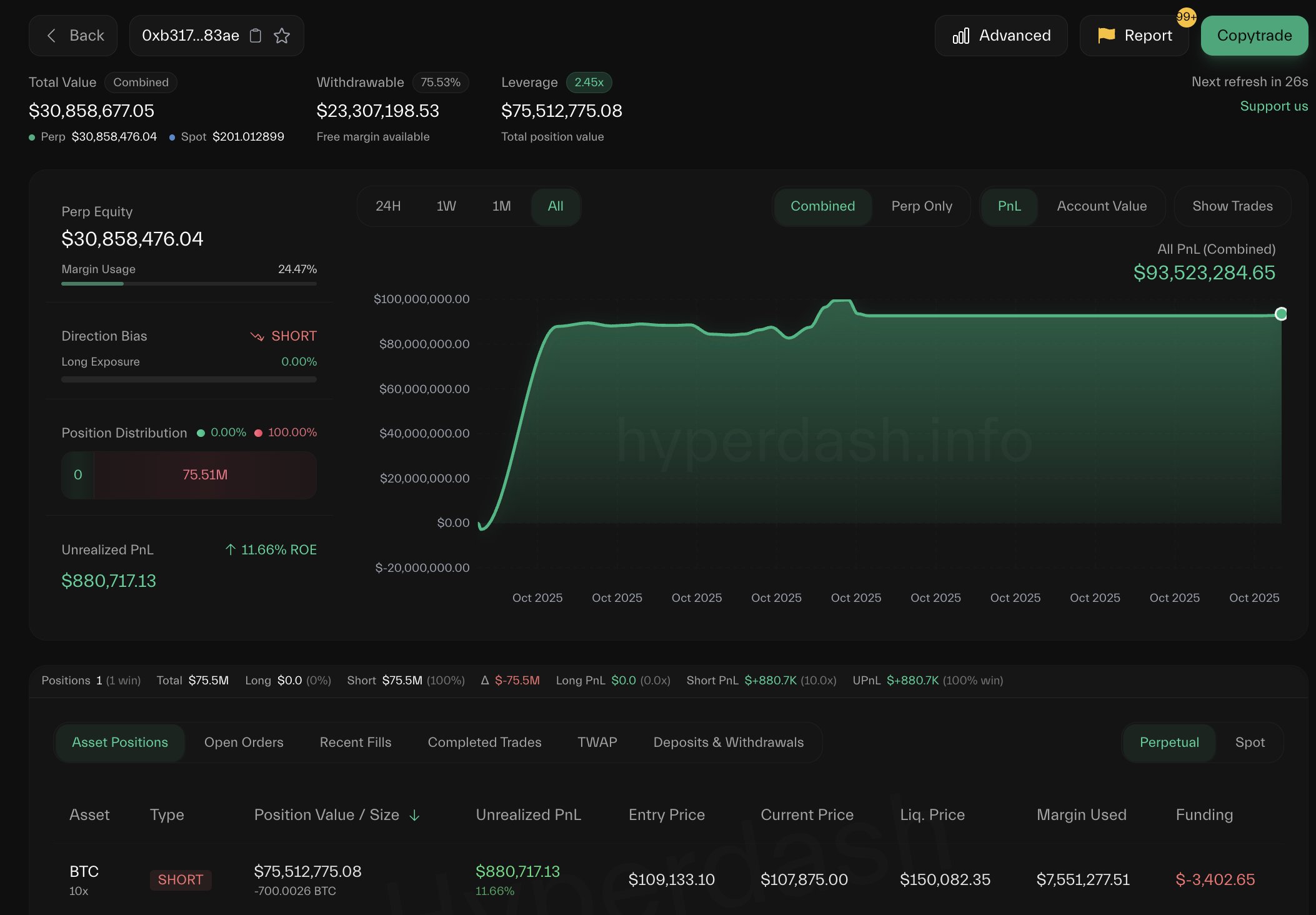

The trader known as BitcoinOG (1011short) — who gained fame for earning over $197 million during last week’s flash crash — is back in action. On-chain data shows that he has deposited $30 million in USDC to Hyperliquid and opened a 10x short position on 700 BTC, worth roughly $75.5 million.

This move has drawn the market’s attention, reigniting speculation about whether the whale anticipates another leg down for Bitcoin. While BTC is attempting to recover above the $110,000 mark, the presence of such a large short position highlights lingering bearish sentiment and a lack of conviction among traders. For now, bulls are fighting to stabilize price momentum, but with whales like 1011short back in the game, volatility is likely far from over — and the market may be in for another sharp move soon.

Whale’s Short in Profit as Market Tension Rises

According to Lookonchain, the whale known as BitcoinOG (1011short) currently holds an unrealized profit of about $880,000, or roughly 11%, on his latest $75.5 million short position opened on Hyperliquid. The trade, placed during Bitcoin’s rebound phase, has quickly gained traction as BTC struggles to sustain momentum above the $111,000 level. This move has sparked unease among investors and traders alike, many of whom view it as a potential warning sign that larger players may be positioning for renewed downside pressure.

Still, analysts warn that this might not tell the full story. While the 1011short address has earned a reputation for precision — notably pocketing $197 million during the October 10 flash crash — the transparency of on-chain data has limits. It’s unclear how many positions this whale currently holds across other exchanges or what the exact strategy behind his trades may be. As such, reading his moves as a simple bearish bet could be an oversimplification.

The next few days will be critical for Bitcoin’s trajectory. If the whale decides to scale his short further, it could intensify selling pressure and drag BTC toward key support levels. Conversely, if he closes out the position or pivots to longs, it might suggest a short-term market bottom. Either way, the setup points to heightened volatility ahead, with traders bracing for sharp price movements as the market digests this high-profile activity.

Related Reading

Bitcoin Holds Weekly Support, but Resistance Looms

Bitcoin is showing early signs of stabilization on the weekly chart, recovering from its October 10 flash crash low near $103,000 to trade around $111,200. The candle structure suggests that buyers are defending the 50-week moving average (blue line), which has acted as a reliable mid-cycle support throughout the current bull phase.

However, the broader structure still shows Bitcoin consolidating below the $117,500 resistance — a level that has repeatedly capped rallies since mid-2025. Until BTC breaks above this zone with strong volume, the market remains trapped in a sideways range, with traders positioning cautiously amid high volatility and uncertain macro conditions.

Related Reading

Momentum indicators point to neutral-to-bearish sentiment, reflecting hesitation among bulls after weeks of heavy liquidations. Yet, the presence of higher lows on the weekly chart continues to support the long-term bullish structure, as long as BTC holds above $106,000–$107,000.

If price manages to reclaim and close above $117,500, the path could open toward $125,000–$130,000, aligning with liquidity pockets from previous tops. Conversely, a weekly close below $106,000 would shift the outlook bearish, suggesting deeper corrections ahead.

Featured image from ChatGPT, chart from TradingView.com